Losses or damages are incurred continuously by motorists, business owners, workers, property owners, etc. These damages or losses should have a financial cover which will protect them from the cost of damage or loss incurred.

The process of getting this financial cushion is known as getting an insurance policy/cover.

This is a contract between an individual or entity and an insurance company to manage the risk. The entity or individual receives protection from a potential loss and pays a fee known as a premium to the insurance company. This is done in preparation for a contingency such as the death of the policyholder or damage/destruction of their property.

So therefore, it is important for insurers to devote time and attention to claim processing to ensure trust between the insurance company and the client, Managing Director of Coronation Insurance, Mr Adebayo Arowojolu has said.

Mr Arowojolu said, though every claim is different and processes can vary slightly according to the situation, insurance companies must devote the time and attention it takes to resolve cases in a prompt manner.

He said one of Coronation Insurance’s commitment to clients is ensuring that, every claim is handled as fairly, professionally, and as carefully as possible.

“If you run into questions or concerns during your claims process with us, you can always contact us to get the answers you’re looking for” he said.

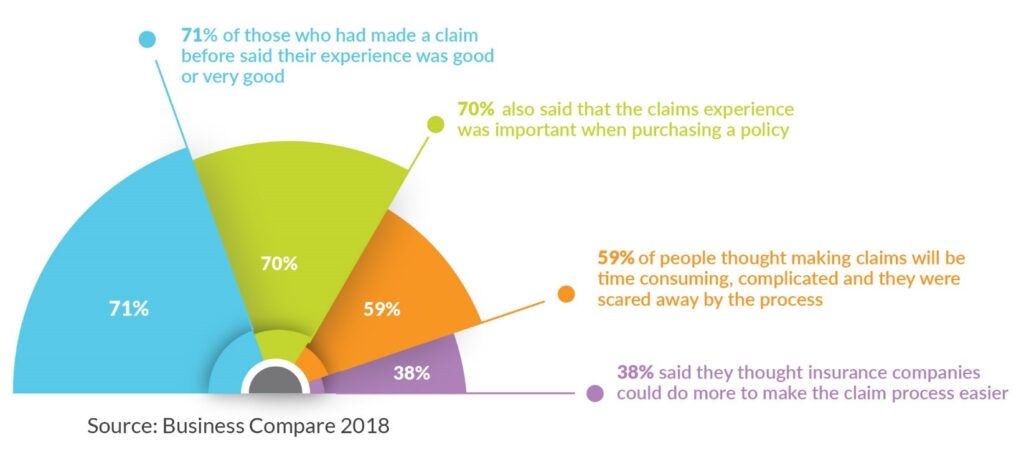

Mr Arowojolu, who was expressing his opinions on a recent survey by claimsrated.com, which revealed that insurance claims processes have an undeserved bad reputation. The online survey of 1,000 people found that, about 38 percent of claimants said they thought insurance companies could do more to make their claim process easier.

Fifty-nine percent of claimants in the survey also feared that making claims could be time consuming and complicated.

But Mr Arowojolu thinks much can be done to change customer perceptions about making and redeeming such claims accordingly.

“At Coronation, we believe insurers are judged by their claim payment process. In view of that, as an insurance company, we ensure that, all policy documents, instructions, claims payment procedures and documents are made available to our customers in all our branches and agency offices. A recent survey conducted by the company showed a satisfactory rating of 91% by our claimants. This is partly because we pay all our claims within 48 hours and adhere to time management practices in dealing with our customers” he said.

He revealed that a recent publication by the NIC on the claims reserves by companies showed that Coronation is among the top 5 companies well placed in paying claims according to the company’s claims reserve.

“This publication places Coronation among the top companies well placed in paying claims”, he noted.

What shapes public perception on claims

In a recent study commissioned by claimsrated.com and conducted by Online Opinions, it was revealed that the insurance claims process has an undeserved bad reputation. The online survey of 1,000 people found that:

Despite these figures depicting a better-than-expected result for the quality of the claims

process, more is being done to improve the process further.

Major areas of contention

Notwithstanding the huge number of claims paid by insurance companies on a daily basis, people still dread going through the insurance claims process. Some of the factors that people believe compound their woes of making a claim include:

- delay due to communication

- misunderstanding about the insurance coverage dissatisfaction with the repair done on one’s property

- dissatisfaction with the amount paid

- Quite apart from the above, the most common complaints insurers receive about claims involve;

- Unsatisfactory settlement offers Delays in the claim process

- How some adjusters handle claims

The NIC and its interventions

The National Insurance Commission (NIC) is the regulatory body of the insurance industry in Ghana. Due to the low confidence of people in insurance and how the claims process is dreaded by many, the NIC has put a lot of initiatives in place to help curb the situation.

Serves as intermediary between insurance companies and the insuring public

The NIC serves as the main intermediary between insurance companies and the insuring public. In situations where there are delays in the settlement of a claim by an insurance company, or there are disagreements in the claim amount to be paid, the NIC comes in to mediate a smooth resolution if the issue is escalated to them.

Bancassurance

We have revolutionised our Bancassurance partnership with Access Bank to ensure that our customers and that of Access Bank have easy access to insurance solutions. With our Bancassurance partnership, we guarantee a same day claim payment for all our customers with claims amount up to GHS 3,000.00. All other claims are paid within 48 hours after execution of Discharge Voucher (DV) irrespective of the amount involved.

Every claim is different, and although the claims process can vary slightly according to the situation, your insurer will devote the time and attention it takes to resolve your particular case. Coronation Insurance is committed to ensuring every claim is handled as fairly, professionally, and as carefully as possible. If you run into questions or concerns during your claims process with us, you can always contact us to get the answers you’re looking for.

You can contact Coronation Insurance through: infoghana@coronationinsurance.com.ng or 0302 772 606/0302 773 616