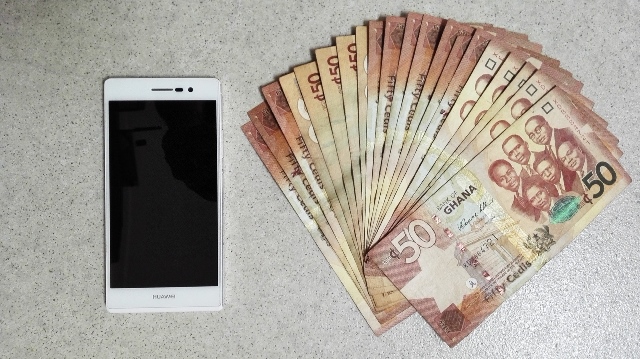

The government has introduced an e- levy on all electronic transactions to widen the tax net in the informal sector.

The proposal is contained in the 2022 Budget.

According to the Finance Minister, Data from the Bank of Ghana confirms a growing trend in online trade.

He said data shows that between February 2020 and February 2021, there was an increase of over 120% in the value of digital transactions compared to 44% for the period February 2019 to February 2020.

“It is becoming clear there exists an enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the ‘informal economy,” Mr. Ofori-Atta observed on Wednesday, November 17, 2021, as he presented the 2022 Budget Statement in Parliament.

“After considerable deliberations, the government has decided to place a levy on all electronic transactions to widen the tax net and rope in the informal sector. This shall be known as the ‘Electronic Transaction Levy or E-Levy’,” The Finance Minister noted.

Mr. Ken Ofori-Atta explained that transactions covering electronic mobile money payments, bank transfers, merchant payments and inward remittances will be charged at an applicable rate of 1.75 percent which will be borne by the sender except for inward remittances, which will be borne by the recipient.

This, however, will not affect transactions that add up to GH¢100 or less per day.

“A portion of the proceeds from the E-Levy will be used to support entrepreneurship, youth employment, cyber security, digital and road infrastructure among others.”

“This tax is one and we shall all pay,” The Finance Minister stressed.

This new levy is scheduled to take effect Saturday, January 1, 2022.