Most drivers have car insurance because it is the law, but that doesn’t mean you should only buy the minimum required coverage. There are many reasons to buy car insurance.

Motor insurance can help protect you and your family from huge expenses. By investing a small amount now in your own protection, you can help avoid costly expenses in the future.

Coverages such as collision insurance, comprehensive insurance, property damage liability, and bodily injury liability can help cover the costs of expensive claims if an accident happens.

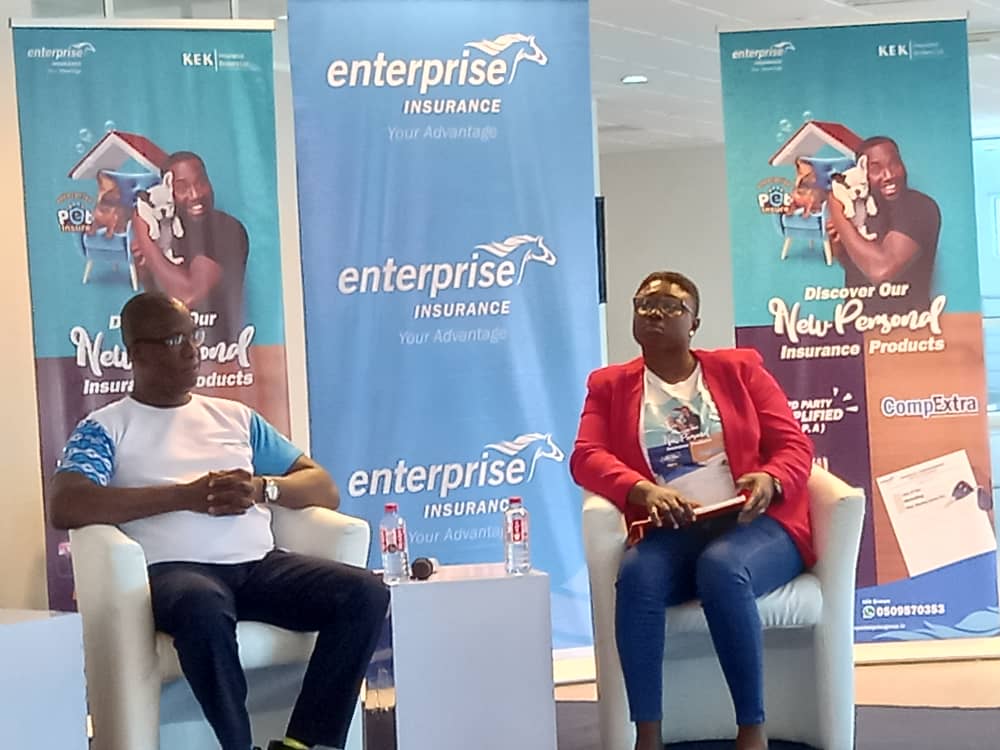

It against this background that Enterprise Insurance has held a one-day sensitization forum to educate the public on Motor Insurance policies, claims and processes.

The event which took place at the company’s Advantage Place office in Accra educated both the physical and virtual participants on motor insurance and its claims payment processes in the country.

According to the Senior Manager In-charge of Quality Assurance at the Enterprise Insurance, Michael Larbi, motor insurance and other forms of insurance enable people to have peace of mind.

“This is because they know that for any unforeseen event the insurance policy that they have will take care of loss they suffered once it is insured under the policy”, he explained.

According to him, there are three types of motor insurance namely-Third Party; Third party, Fire and Theft; and Comprehensive.

Mr. Larbi explained that under the Third Party Insurance of the Motor Insurance, the policy indemnifies policyholders and any permitted driver in respect of their legal liability to third parties for death and bodily injury as well as claims for damage to other persons’ property.

“So this Third Party Insurance policy takes care of your liabilities to third party. If you run into somebody’s vehicle, the third party property damage will take of that.

For instance, if you (policyholder) run into somebody’s fence wall or somebody’s kiosk by the roadside or even an electric pole by the roadside and you run into any property your third party insurance will take care of that up to a certain limit”, he further explained.

The current standard limit for third party property damage is GH¢5000. However, Mr Larbi stated that it could be increased at the policyholder’s request to the amount that he or she deem fit for himself or herself.

It normally comes in thousands of Ghana cedis. From GH¢5000, the policyholder(s) can do GH¢6000, GH¢10,000, GH¢15,000 as he or she deems for himself or herself, he added.

“Then when it comes to the bodily injury and deaths that has to do with when a policyholder runs into somebody the person may get injured or may even die.

Your Third Party insurance will take care of the liabilities for such unfortunate events. The medical bills that will arise, the compensations that will come as a result of the injury will be taken care of under the Third Party insurance”.

In addition to the Third Party cover described above, this Third Party, Fire and Theft policy covers policyholder(s) vehicle against the risks of fire and theft.

It is a build up on the Third Party insurance. Apart from having the standard cover which is the Third Party bodily injury and death and the Third Party property damage limit, the Third party, Fire and Theft adds the fire risk.

For instance, he explained: “If the car gets burned either whole or portions of it. And then also when parts of the vehicle are stolen or the entire vehicle is stolen as theft, you also have insurance for that. These form the Third party, Fire and Theft cover”.

Then ultimately, the grand of all is the Comprehensive insurance. It is also the build up on the Third Party, Fire and Theft.

The comprehensive policy covers all of the risks described above, in addition to accidental damage to policyholder’s vehicle.

“So apart from having the basic third party and the fire and theft aspect, in addition to that we also have what we call own damage cover. So when you run into somebody and your vehicle is damaged apart from taking care of the liabilities to the third party, when your vehicle is also damaged, we will also take care of it under the Comprehensive insurance.

So any damage to the vehicle you will have that covered under the Comprehensive insurance in addition to all of the types of cover mentioned earlier”.

So the Comprehensive insurance is the widest, while the Third Party is most basic insurance. If you don’t take any insurance cover at all, you should have the Third Party insurance, Mr Larbi appealed to vehicle owners and motorists.

“For Enterprise we have always known to be the first to do things first on the market. Recently, we have enhanced our motor insurance policies. So the Comprehensive, we have what we call the CompExtra (Enhanced Motor Comprehensive policy).

This policy provides cover for things that are not usually covered under the standard comprehensive insurance. So typically under the comprehensive insurance, you don’t have what we call loss of use benefit, he indicated.

Loss of use benefit: “Normally, when your vehicle is involved in an accident and it has to go for repairs, so for the time that the vehicle is being repaired you have to find your own means of transportation. This is more like an extra cost to you because you don’t have the use of your vehicle. So, the loss of use, we are saying that under the CompExtra, we are providing cover for that”.

Misfuelling: We are also providing cover for what we call misfuelling. It is where your vehicle is running on petrol but you go to the fuel filling station and the attendant mistakenly filled it with diesel.

Or your vehicle is running on diesel and it is mistakenly fueled with petrol. This can cause damage to the engine. We are also providing cover for it under the CompExtra”.

Then for the occupant of the vehicle, typically under a comprehensive insurance policy, it is only the driver who has a personal accident cover.

The insurance company has gone ahead to also provide the personal accident cover for the other occupants of the vehicle who are the passengers.

This is an extra personal accident cover under the policy for passengers in the vehicle. All these are available under the CompExtra policy.

The company has also enhanced its Third Party insurance by adding certain benefits which are usually not available under the standard third party cover.

“So we are saying that for damage to your windscreen, side-mirrors and then minor scratches, we will bear the cost of those damages under the Third Party Amplified (Enhanced Motor Third Party) up to a limit of GH¢5000 per annum. This is new on the market. It is first on the market and it is only from Enterprise Insurance”, Mr Larbi stated.

Touching on pricing of the motor policies, he said: “Our regulator the National Insurance Commission (NIC) has issued tariffs that we go by. They are usually updated from time to time. So, it is a regulated market. They are fixed prices for all types of vehicles”.

The key thing to consider or factors that are very key in determining the price is the usage of the vehicle. For instance, two persons may have a saloon vehicle. One says he will use it for personal and social purposes. The other says he will use it for Uber business. So, the pricing will be different.

The pricing is not based on the type of car. It is rather based on the usage. So, you don’t complain by saying that how come we both have saloon cars but my price is higher than the other.

You may be using it for commercial purposes which is higher and then other may be using for personal and social purposes. So, the usage is very key. So, this is for a third party typical.

Usage is also very critical for the other types of cover-third party, fire and theft; and comprehensive. For comprehensive, third party, fire and theft, apart from the usage, the key factor also to consider is the value of the vehicle, and the year of made, so the higher the value the higher the premium, according to him.

On the 1st of January 2020, the NIC introduced the motor insurance data base. It is a portal that is used for underwritten motor insurance. It has all data on all insured vehicles in the country.

The object is to ensure that there is standard pricing and also to ensure that the issue of fake motor insurance stickers is done away with. That is the key objective for the motor insurance data base.

It is also for the purpose of verification so to know whether the insurance you have done whether it is valid, whether it is genuine or not all you have to do is type *920*57# and then it will give you a front you put in your vehicle number and it will indicate the car number, the insurance company, the period of insurance, among others. This will enable the car user or owner knows that the policy genuine or fake.

Touching on motor claim processing channels, the Head of Same Day Claims at Enterprise Insurance, Madam Bernice Davies, said: “At Enterprise Insurance, we have two main claim processing channels. We have the Same Day Claims payment service; and the mainstream”.

According to him, the Same Day Claims payment channel was introduced in 2018 in the company’s quest to satisfy its clients to exceed their expectation by way of claims payments.

This service enables the company to pay to minor motor insurance claims on the same day. By minor motor insurance claims, she means claims that are up to GH¢5000.

The requirements for same day claims payments, Madam Davies mentioned are- damaged vehicle must be present for physical inspection at the Same Day office at Airport branch together with the policyholder’s driver’s licence, among others.

She also added that the payment options for same day claims payments are-bank transfer; and mobile money. While the other claims that are not qualified for same day are processed at mainstream at the various offices of the company.

What to do after an accident

Madam Davies used the occasion to remind policyholders to always secure their accident scenes; report to the nearest police station; they should not admit liability; and they should notify their insurers on time.