Once looked upon with suspicion and cynicism and treated as a ‘grudge purchase’ at best, the insurance landscape has, in recent years, witnessed a significant turnaround globally, and Ghana is no exception.

This can be attributed largely to the increased sensitization by insurance regulators and companies, as well as positive word-of-mouth testimonials by persons who have benefited from insurance through duly paid claims.

The pick of the lot, however, has been the introduction of relevant, tailored consumer-centered products and multiple channel options for customers.

From healthcare to motor insurance, the enlightened customer can testify of the goodness of holding an insurance policy. Even Small and Medium-sized Enterprises (SMEs) have come to the realization that their age-long problem of access to finance can be addressed by taking out insurance policies which consequently de-risk their business profile and help them gain credit and attract investment.

The comfort of a company providing a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a specified premium has given the public confidence in the importance and benefit of insurance and has grown as a key element in the wider financial inclusion agenda.

A problem shared

With insurance being a game of numbers, companies are constantly seeking strategies to minimize risk – internally and externally – and provide the best returns possible.

To grow their clientele base, insurance companies have deliberately created multiple sales channels through which potential clients can be reached with their products.

Prominent among such channels has been the collaboration with banks. Despite recent developments in the financial sector, the reach and influence of banks remain unrivaled. The product of this union between insurance firms and banks, which has revolutionized the landscape is Bancassurance; an arrangement wherein the bank acts as a distributor of the insurance company’s products and as a mediator between their clients and the insurance company.

Despite the mutual benefit for all stakeholders – banks, insurance firms, and customers – competing interests could derail an otherwise fruitful relationship. As such, the arrangement requires the total commitment of all, particularly, the banks.

Standard Chartered sets the pace

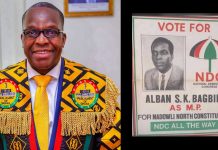

For this reason, the pioneers of bancassurance on the Ghanaian insurance market need not go unmentioned and must be heralded for deepening financial services delivery and creating the path which many tow today.

The first Bancassurance partnership formed in Ghana was between Enterprise Insurance Company Limited and Standard Chartered Bank in 2007.

This made Standard Chartered Bank the first corporate agent in the Ghanaian insurance industry. Through the bank’s efforts, Bancassurance partnership channels are currently considered a great resource for building and widening the clientele base of insurance companies and further, growing their market share.

As a pioneer, Standard Chartered has in the past 12 years invested heavily in automation of its sales process, application processing, claims, and complaint management. The result is a seamless customer experience.

Through an aggressive forward-thinking approach, Standard Chartered was swift in creating an electronic point of sale (ePOS) for its Bancassurance business; a move that has served it well in the rapid, digital-first world of today.

Standard Chartered leverages its existing client relationship management expertise and systems to serve its clients in the best way possible. Among the many reasons Standard Chartered clients buy insurance are;

a. Trust: As the oldest bank in the country, with some 125 years of first-class banking experience, in which time it has served as Central Bank of the Gold Coast and being listed on the Ghana Stock Exchange since its inception affirms Standard Chartered’s credibility. Coupled with its best-in-class research-driven operations, customers trust Standard Chartered to sell them the right product.

b. One-stop-shop for All Financial Needs: Customers have become increasingly demanding and want an amalgamation of all their financial services under one roof. Standard Chartered offers this and more.

c. Expert Advice:With well-trained insurance specialists and relationship managers on wealth management and banking solutions, clients receive prudent advice on building wealth and protecting their assets through insurance.

d. Ease of Renewals: Standard CharteredBank handles policy renewals for its client. With new tech and data access, tracking the renewals and CLAIMS is very easy.

e. Improved Application and Policy Processing Time: Having data of clients make information readily accessible in real-time. This reduces turnaround time in new sales processing, complaints, and claims management.

f. Easy Access to Claims: Standard Chartered Bank makes sure its clients are delighted with service, hence the effort we put in making easy the claims process. This is what makes Bancassurance especially in Standard Chartered successful and its clients, happy to buy insurance through us.

- Reputable Insurance Partners: Standard Chartered has partnered with credible, reputable and market leading insurance companies to bring the best solutions to our clients. These insurance companies are Prudential Life Insurance Company Limited for their life insurance solutions and Enterprise Insurance Company Limited for their general insurance solutions.

Claim or break

While policy purchase is key to building a wide clientele base, attention must be focused on the growth of renewals, new sales, and claims. Claims management is the defining moment in the insurance customer relationship. To retain and grow market share and improve customer acquisition and retention rates, insurers are expected to be focused on enhancing customer claims experience.

It is the make-or-break season as depending on the experience, clients would build trust confidence in the insurance company and industry or grow to resent them. Whiles some insurance companies do their best to give client memorable experiences, others do the opposite. This why buying your insurance from a reputable insurance company or through a reliable agent such as Standard Chartered Bank can be of great help especially for the purpose of resolving complaints and claims.

The Standard Chartered Way

Standard Chartered, being the oldest bank and corporate insurance agent, prides itself on doing the right thing for its clients. When clients patronize product and services, it is based on the trust, integrity, and goodwill of the brand.

The assurance clients have that they are being served the best products that fit their financial needs and guarantee they will have access to all the benefits due them from the products purchased is what has made the bank the best and most preferred bank in the market.

As such, purchasing insurance products with Standard Chartered does not come with just the sense of protection but also convenience, speed of execution, fair treatment, and respect.

The Bank distributes insurance products for globally acclaimed and reputable insurance companies such as Prudential Life Insurance and Enterprise Insurance Company Limited. These companies are held to high standards on customer service because the condition of partnership is hinged based on ‘Think Client’, with a team of well-trained frontline advisors who guide the insured through every process.

Bancassurance allows two distinct, yet similar, sectors to provide a more rounded product offering to its clients. The financial services delivery industry deserves the highest standards of operation and client service and with Standard Chartered, you can rest assured.