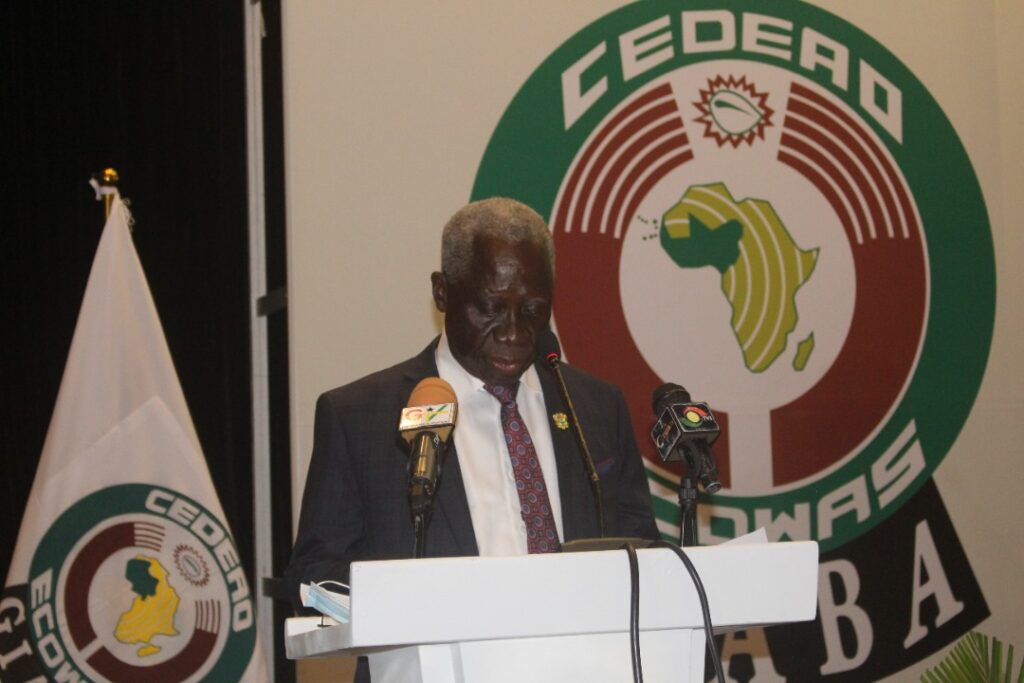

Ghana’s Minister of Finance who doubles as the Chairman of GIABA Ministerial Committee (GMC), Hon. Ken Ofori Atta, at the opening of the 24th GMC Meeting on Saturday held at the Movenpick Ambassador Hotel, challenged member states within the ECOWAS region to take drastic measures against organised financial crimes and terrorism financing.

The meeting was also used to adopt, amongst other things, the Second Round Mutual Evaluation Report of the Republic of Guinea Bissau as well as approve some important decisions taken at the just ended 36th GIABA Technical Commission/Plenary Meeting in Accra.

The finance minister’s call comes at a time when organised financial crimes and terrorism financing have taken an entirely different dimension threatening peace and security in West Africa.

“I want to encourage all member States to also take the necessary steps in strengthening their Anti Money Laundering (AML) Counter Financing of Terrorism (CFT) regime,” he charged.

He further challenged ECOWAS member states to work and ensure proper frameworks and institutional mechanisms are put in place to ensure they do not lose out on international trade transactions or experience significant capital loss by channeling development funds towards terrorist activities.

According to the finance minister, no responsibility is more important than the efforts of member states to stop the flow of illicit finance in the wake of the many challenges brought about as a result of the COVID-19 pandemic.

“As COVID-19 crisis evolves, the goals facing us now are to ensure that despite the pandemic, the resources of our land are shared fairly among all its people through reconciliation of private enterprise with social mobility, economic justice, and human capital development. There are many challenges ahead to ensure that we recover from the pandemic; however, no responsibility is more important than our effort to stop the flow of illicit finance,” Hon. Ken Ofori Atta emphasised.

Touching on some statistics, he revealed that an estimated 2-5% of global GDP, or between $800 billion – $2 trillion in current US Dollars is lost to money laundering globally.

“This amount is almost 120% of the GDP of ECOWAS region. Also, according to the UNCTAD, $88.6 Billion of resources are lost to IFFs on the African continent. These IFFs encompass trade misinvoicing, money laundering, and aggressive tax evasion facilitated by an extensive network of entities comprising multinationals, financial institutions, and spurious legal structures.”

The finance minister also raised serious concerns about resurgent terrorism in the ECOWAS region.

“As I mentioned at our last GMC Meeting in October 2021 via Zoom, resurgent Terrorism in the West African region, particularly Nigeria, Mali, and Burkina Faso, is a significant concern for all of us. The UNCTAD estimates that of the $31.5 billion in IFFs generated annually in conflict areas, 96 percent is used by organised criminal groups, including violent fuel conflict. Hence, there remains an urgent need for a concerted effort from all relevant stakeholders to help “cut” the funding source for these terrorist groups.”

He also commended the government and the people of Guinea Bissau for successfully going through the Second Round of Mutual Evaluation of its AML/CFT regime.

Hon. Ken Ofori Atta also urged Guinea Bissau to further concentrate on implementing the recommended actions as part of efforts to help clamp down on money laundering and terrorist financing.

“I want to congratulate the government and people of Guinea Bissau for successfully going through the Second Round of Mutual Evaluation. I know it is not an easy task but by God’s grace, you are through. The essence of this whole exercise is to help us identify weaknesses in our AML/CFT regime for us to take the necessary steps to address same.”

He assured colleague member states, Senegal, Burkina Faso, Mali that are currently closely being marked under FATF ICRG Observation, that GIABA was fully behind them to ensure that they exit the process.

Mr. Ofori Atta was confident that this exercise will propel a renewed focus to remedy the various deficiencies in AML/CFT systems of member states by leveraging GIABA’s extensive network.

He also called on member states to rally behind GIABA in combating money laundering and terrorist financing.

“On behalf of the GMC, I want to reiterate our commitment to implementing the Effectiveness Improvement Action Plan to strengthen GIABA in delivering its mandate to the FATF global community.

As we advance, I ask that we continue to support the activities of GIABA in combating the financing of terrorism in our region. Our institution (GIABA) may not be perfect. Still, we must acknowledge that we have made significant progress over the years towards permanently closing “loopholes” that have denied economic opportunities for the many in the interest of a selfish few.”

He expressed his heartfelt appreciation to the entire GIABA Secretariat, the Technical Commission, and all the working groups that worked tirelessly to have a successful Plenary Meeting in Accra, Ghana from February 13th-18th 2022.

“Finally, I once again challenge the FATF to incorporate more of an “African Voice” in its standard-setting regulatory and operational measures relevant to meet the region’s diverse requirements. As it stands, South Africa is the sole member of FATF. Until this is changed, we might not be able to answer critical questions on the root causes and “state-of-play” for IFFs in Africa, the institutional mechanisms and regulatory structures which advance IFFs on the continent, and the value from reclaiming IFFs for financing the sustainable development goals for African countries,” he underscored.