The Chamber of Cement Manufacturers, Ghana (COCMAG) has expressed strong concerns over the proposed Ghana Standards Authority (Pricing of Cement) Regulations, 2024 (L.I.), labeling it as a heavy-handed attempt at price control under the guise of transparency.

In a detailed statement, COCMAG highlighted several problematic aspects of the proposed regulations.

Specifically, regulations 3(4), 3(5), and 3(6) empower a government committee of scientists at the Ghana Standards Authority (GSA) to reject a cement producer’s reported price without providing an explanation or allowing an appeal.

Additionally, these regulations would prohibit producers from selling cement unless their price is approved by the committee, with non-compliance resulting in the suspension of their license.

While acknowledging the importance of price transparency, COCMAG questioned the suitability of the Price Control Committee (PCC) to manage such a complex issue.

Below is the full statement:

Cement Standoff: Industry Cries Foul Over Opaque Price Controls

Accra, Ghana – A storm is brewing in Ghana’s construction sector as the Chamber of Cement Manufacturers, Ghana (COCMAG) raises serious concerns about the newly proposed Ghana Standards Authority (Pricing of Cement) Regulations, 2024 (L.I.). While the Director-General of the Ghana Standards Authority (GSA), Prof. Alex Dodoo, and some within Parliament portray the L.I. as a mechanism to ensure transparency in the industry, COCMAG argues it’s a heavy-handed attempt at price control.

Unilateral Power, Unclear Process

The crux of the issue lies in regulations 3(4), 3(5), and 3(6) of the L.I. These provisions empower a government committee of scientists at the Ghana Standards Authority to reject a cement producer’s reported price without explanation or a chance to appeal.

Furthermore, producers are prohibited from selling cement unless the committee approves their price. Non-compliance can lead to license suspension.

Questionable Expertise for Price Setting

While price transparency is a laudable goal, the proposed regulations raise concerns about who wields the price control power. The price control committee (PCC) is composed primarily of six scientists, led by Prof. Dodoo, a pharmacist. While their expertise in ensuring quality standards is undoubted, one wonders if a committee dominated by scientists possesses the nuanced understanding of market dynamics critical for setting a fair price for a complex commodity like cement. Can they effectively balance production costs, globally- and locally-traded inputs, and the long-term health of Ghana’s cement industry, better than the free market?

Industry Questions Lack of Consultation

COCMAG emphasizes that these regulations were drafted without any meaningful consultation. While some might suggest a meeting was planned, the facts paint a different picture. Cement companies were summoned via a last-minute WhatsApp message on a Sunday evening for a meeting the following morning, with no agenda provided.

Upon arriving for the meeting, CEOs were surprised to find media present, raising concerns about transparency and potential media misrepresentation. Ultimately, the CEOs were informed that the Minister was unavailable to meet them.

Cement Industry: Fairness Amidst Challenges

Despite the narrative of profiteering, Ghanaians should be aware of the challenges the cement industry faces. The cedi depreciation by 104% since 2022 has significantly increased production costs, with 77% of cement inputs being dollar-denominated. However, the industry has stood by Ghanaians in this difficult period and only raised prices by 48% in the same period, absorbing a significant portion of the cost increases. Without this absorption, the price of cement should have been $2.30/bag (GHS 35/bag) higher than it is.

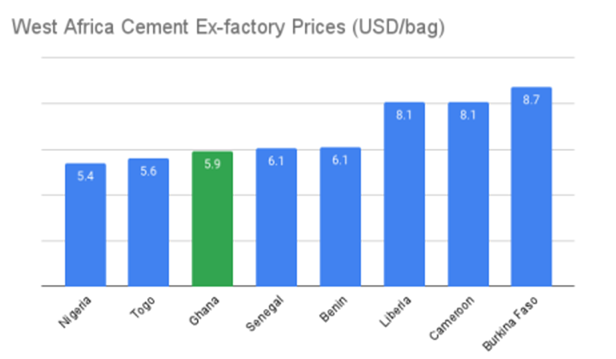

Ghanaian Cement Industry: A Model of Competition

Furthermore, Ghanaians deserve to know that their cement industry is one of the most competitive in West Africa, boasting one of the highest number of manufacturers among regional peers. Ghana’s 14 individual producers outnumber Nigeria’s 12 and Togo’s five. In fact, Ghana’s cement prices are among the lowest in West Africa, although 30% of the cost build-up is paid to the government in taxes, levies, and service charges.

Unfair Targeting, Unintended Consequences

COCMAG argues that the Minister’s actions are unfair and not in the best interests of Ghanaians. While other sectors have experienced far higher price increases, the cement industry is being singled out for control. This approach could lead to:

● Reduced Production and Shortages: If the government-imposed price does not cover production costs, manufacturers may be forced to reduce production, hindering construction projects.

● Job Losses: Reduced production can lead to job losses within the cement industry and related sectors.

● Discouraged Investment: Without the ability to determine a fair market price, investors are

less likely to invest in expanding production capacity, potentially leading to future shortages.

Cement Industry Not Alone in Opposition

COCMAG is not alone in its opposition to this L.I. Several professional bodies have spoken out, including the Ghana Chamber of Construction Industry, GREDA, Importers and Exporters Association of Ghana, the consumer protection organization, CUTS International, all expressing concerns about the proposed regulations’ impact on the industry and ultimately, Ghanaian consumers.

The Way Forward: Collaboration, not Coercion

COCMAG urges the government to reconsider this heavy-handed approach and engage in constructive dialogue with the industry. Transparency in cost structure, a focus on long-term solutions like promoting local sourcing of raw materials, and open communication are key elements for ensuring a sustainable and affordable cement supply for Ghana.