In Ghana, where industrial policy is closely intertwined with political agendas, the upcoming elections provide an opportunity to scrutinize the proposed industrialization plans of the major political parties.

This analysis will focus on how the manifestos of the National Democratic Congress (NDC) and the New Patriotic Party (NPP) measure up against the goals of sustainable industrialization and global competitiveness.

Are these policies effective, feasible, and capable of propelling Ghana into the future of Industry 4.0, or do they risk leaving the country behind in the global industrial race?

In 2024, Sub-Saharan Africa is projected to be the second-fastest-growing region globally, following Asia, with an expected GDP growth rate of 3.8%, surpassing the global average of 3.2.%. West Africa, led by Nigeria and Ghana, is set for a strong 4.5% growth in 2024.

East Africa will grow at 3.9%, while Southern Africa’s growth is forecast at 3.2%. South Africa is now the biggest economy in Africa, with a GDP of $373 billion in 2024. Its diverse economy, led by the industrial sector, has been key to its success.

The country excels in manufacturing, mining, agriculture, and tourism, driving its growth. Africa’s growth rate will be 3.5%, increasing to 4% in 2025. (WorldStatistics)

Africa has increased its medium- and high-technology exports—from 26.6% and 4.0% in 2012 to 31.9% and 4.3% in 2019.

The opposite trend is observable in resource-based manufacturing and low-technology products, with their share dropping from 55.6% and 14.7% in 2012 to 49.6% and 14.3% in 2019, respectively.

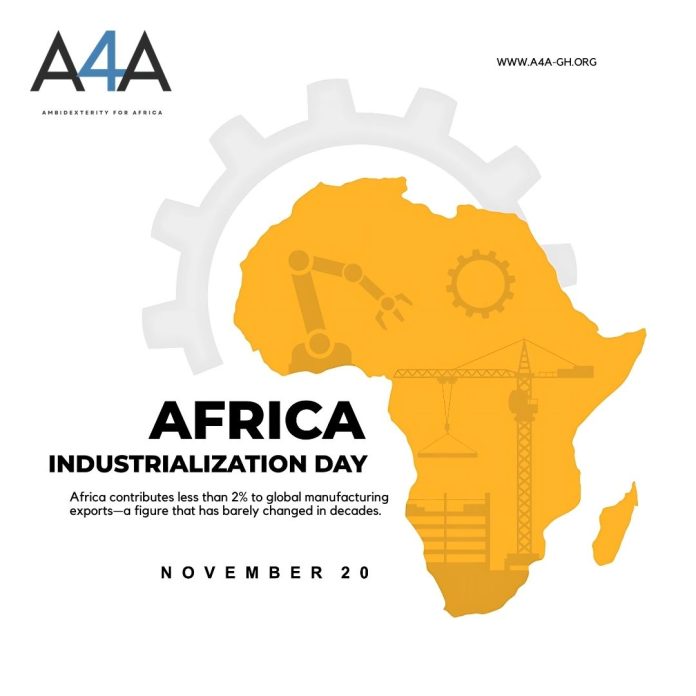

This positive development in the technological upgrading of Africa’s export mix unfortunately looks better than it is —the continent’s share in global manufacturing exports remains low at approximately 1.3%.

This statistic highlights the need for stronger integration into global value chains and more robust industrial policies to bridge the gap between potential and performance.

(UNIDO report published in 2020 entitled “African Industrial Competitiveness Report: An Overview of the Manufacturing Industry in the Region” – Observatoire Europe-Afrique 2030” in April 2022.)

As Africa observes Africa Industrialization Day, Ghana’s industrial landscape is under scrutiny.

With the 2024 elections drawing near, the industrialization policies laid out by the country’s major political parties, the National Democratic Congress (NDC) and the New Patriotic Party (NPP), highlight both ambitions and challenges in aligning with continental and global industrial trends.

NDC’s Vision for Industrialization

The NDC’s manifesto introduces the Rapid Industrialization for Jobs Program, aimed at reviving dormant industries and launching new ones to boost employment and local production.

While ambitious, the plan’s success will depend heavily on sustained investment, infrastructure development, and effective public-private partnerships.

Analysts note that while such initiatives could invigorate the economy, questions remain about their long-term feasibility and whether they can effectively position Ghana within global manufacturing and supply chains.

Global Context

Countries like India and Vietnam have successfully implemented policies to revive industries by creating industrial parks and incentivizing local manufacturing.

These models show that the success of such programs depends on clear regulatory frameworks, skilled labor availability, and incentives for both local and foreign investors.

NDC’s policies, while ambitious, may face obstacles if these foundational elements are not solidly in place.

NPP’s Strategic Industrial Agenda

The NPP’s policies build on agricultural foundations with programs like Planting for Food and Jobs and One Village, One Dam.

These initiatives aim to create a steady flow of raw materials for industries and integrate modern technologies and climate finance into industrial efforts.

While aligned with sustainable practices and industry modernization, the party’s strategy faces challenges, including scalability and the practicalities of technological integration.

Observers have pointed out that without substantial investment and support, these policies risk falling short of their potential.

Comparison to Successful Policies

Countries like Malaysia and Brazil have leveraged agricultural productivity as a basis for industrial growth, integrating agro-processing industries and promoting exports.

These nations benefitted from consistent government investment in infrastructure, research, and development.

For Ghana, while the NPP’s policies reflect strategic alignment with these examples, challenges in infrastructure, logistics, and skilled labor availability could limit efficacy.

The Global Context and Ghana’s Standing

Africa’s manufacturing sector, which contributes only about 1.3% to global exports, shows the continent’s need for more robust policies and strategic action.

High-tech industrial adoption remains limited, positioning Africa behind leaders like Germany and South Korea, known for their advanced Industry 4.0 practices.

For Ghana to keep pace, experts argue that current policies must not only aim for immediate gains but also prepare for future industry standards through investments in digital transformation and sustainable technology.

For Africa to achieve its full industrial potential, stakeholders must champion strategic investments, sustainable practices, and partnerships that advance innovation and economic progress.